UAE: The preferred destination for Foreign Direct Investments

Pallavi Kishore, Senior Lecturer and Ajit Karnik, Professor Middlesex University Dubai

ABSTRACT

The recent UNCTAD World Investment Report shows that the UAE has emerged as a global magnet for foreign direct investment (FDI). This performance of the UAE is especially commendable given its small size in terms of its population and its aggregate GDP. This note identifies the factors that have led to the UAE’s success in attracting FDI. Some of these factors are its location, political stability, infrastructure, economic diversification and quality of life. The large inflows of FDI clearly represent a vote of confidence in the UAE as a favourable destination for foreign investments.

Introduction

The United Arab Emirates (UAE) has emerged as a global magnet for Foreign Direct Investment (FDI). In terms of FDI inflows, the UAE witnessed a record high of Dh84 billion ($23 billion) in 2022, as the United Nations Conference on Trade and Development (UNCTAD, 2023) recently reported. This remarkable achievement occurred despite global FDI inflows declining by 12% to $1.3 trillion. Despite the UAE GDP being only USD 428 billion (at constant 2015 US$), it has outperformed larger economies in attracting FDI, demonstrating its resilience and attractiveness as an investment destination.

Determinants of FDI Inflows

The most popular theory of FDI used extensively is Dunning's Ownership, Location, and Internalisaon (OLI) approach. While Ownership and Internalisaon focus on micro factors specific to the business carrying out the FDI, the Locaon factor focuses on the characteristics of the host country. Host country factors that have been identified as being essential to attract FDI are (a) economic, (b) financial and (c) institutional. Rigorous research by Pallavi Kishore has established this for a panel dataset of more than 150 countries.

Applying Pallavi Kishore's (Kishore, 2023) research to the UAE enables us to identify these locational factors:

- Strategic Location and Political Stability: The UAE's strategic location bridges the East and the West, making it an attractive business hub. Coupled with its stable political environment, the UAE offers investors certainty and security for their investments.

- Infrastructure Development: The UAE's commitment to infrastructure development has resulted in world-class facilities, including modern ports, airports, transportation networks, and logistic centres.

- Free Zones and Special Economic Zones: The UAE's establishment of free and special economic zones (SEZs) has played a crucial role in attracting FDI. Prominent free zones like Dubai International Financial Centre (DIFC) and Jebel Ali Free Zone (JAFZA) have become thriving hubs, attracting international businesses and driving economic activity.

- Economic Diversification: The UAE has significantly diversified its economy beyond oil and gas. This diversification strategy has attracted investment across a range of industries and reduced dependence on oil revenues.

- Quality of Life: The UAE offers a high standard of living, modern amenities, world-class healthcare facilities, and a safe environment for residents and businesses. This quality of life, combined with a cosmopolitan and multicultural society, attracts professionals and entrepreneurs from around the world. Numbeo's data reveals that Abu Dhabi, Ajman, and Dubai rank among the world's top five safest cities, reinforcing UAE's appeal as a secure and stable destination for living and working.

UAE's Locational Advantages

The factors identified above resonate with the high position the UAE enjoys in diverse rankings put forward by various institutions.

- According to the World Citizenship Report 2023, the UAE achieved favourable rankings in mobility (20th), financial freedom (28th), and quality of life (32nd). These rankings affirm the UAE's appeal to residents and investors alike.

- The now defunct World Bank's Ease of Doing Business index ranked the UAE at number 16 globally and highest in the Middle-east in 2020 (World Bank, 2020)

- The IMD Global Competitiveness Report ranked the UAE 10th globally in 2023 and the first among Arab countries.

- The UAE has consistently ranked very high in the World Governance Indicators in terms of Political Stability, Government Effectiveness, Regulatory Quality, Rule of Law, and Control of Corruption (World Bank, 2023)

UAE's FDI Performance

It is no surprise that the results of the World Investment Report 2023 show the performance of the UAE in a very favourable light. The UAE, a small country with a GDP of just under USD 500 billion, cannot possibly attract large volumes of FDI. This is because inflows of FDI depend on the absorptive capacity of country and the larger the GDP the greater is the volume of FDI that can be absorbed. However, adjusted for its economic size, its performance is remarkable.

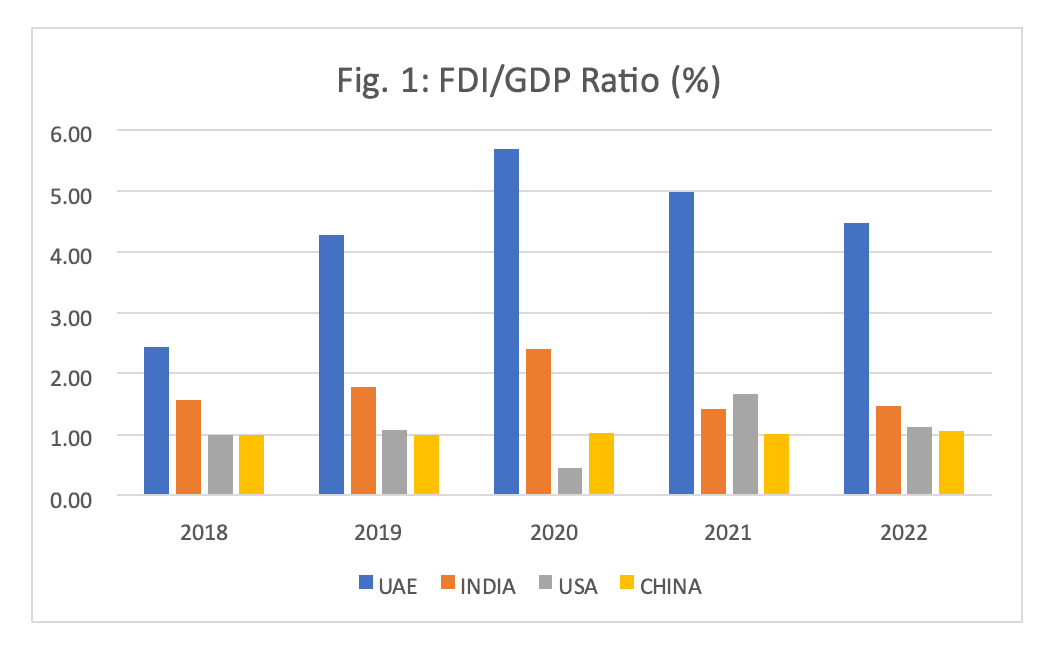

The FDI/GDP ratio for the UAE has been the highest since 2019 among a group of countries that includes China, India, and the USA, all of which are top recipients of FDI (Figure 1).

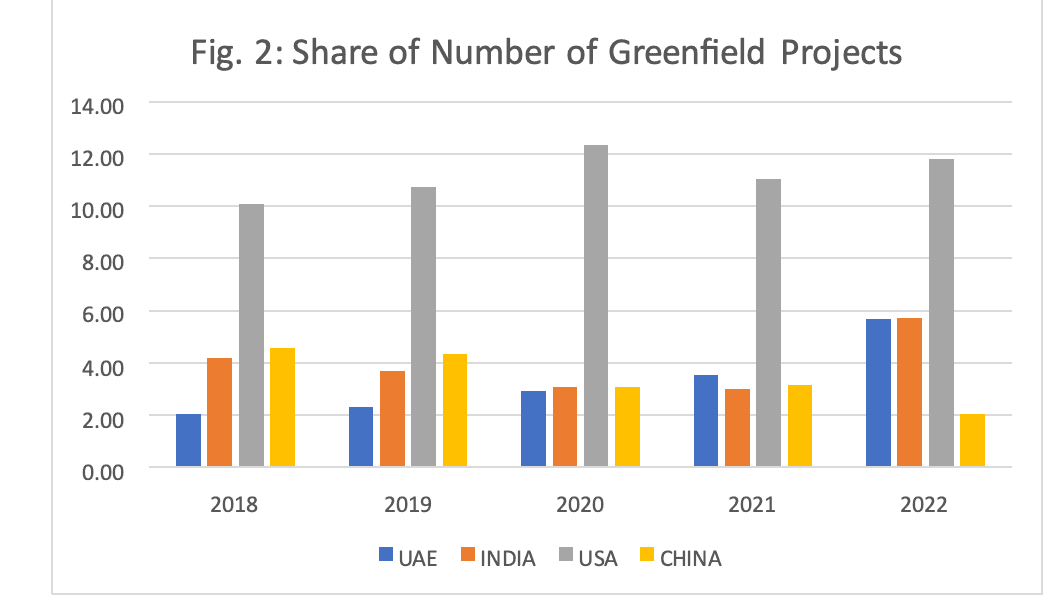

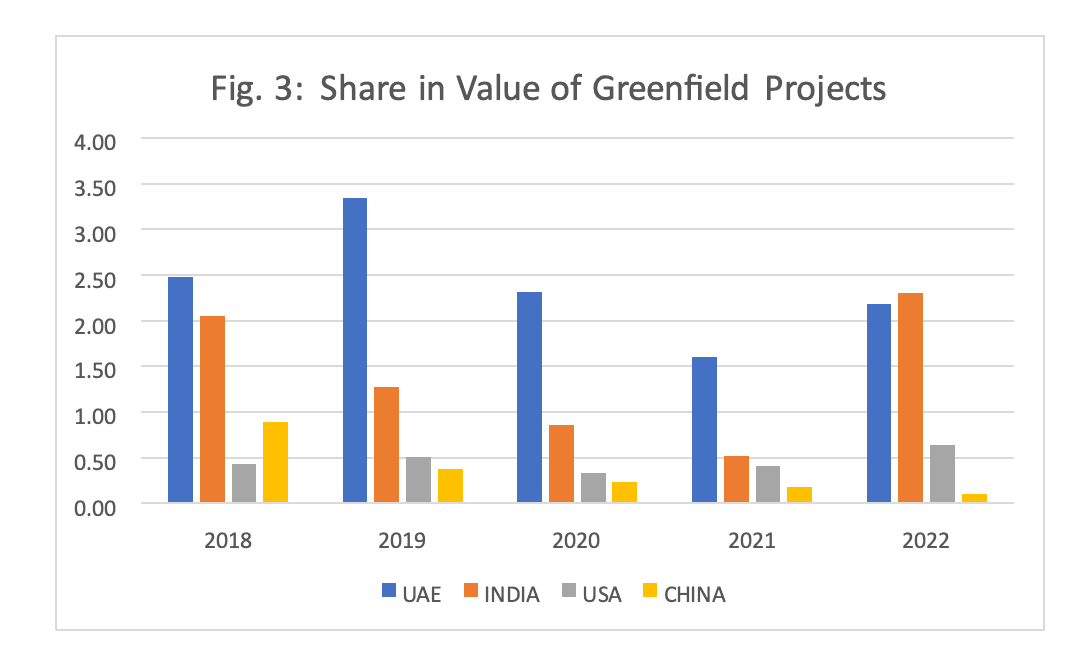

In terms of greenfield investments, the UAE punches way above its weight. The UAE stands at number 4 in the world in terms of the number of greenfield projects, just 11 behind India, which has a GDP almost seven times that of the UAE. UAE's share of projects has caught or exceeded that of the countries (excluding the USA) shown in Figure 2. The UAE also does commendably well in terms of the value of greenfield projects: the ratio of the value of greenfield projects to GDP for the UAE has been the highest from 2018 to 2021 and is second only to India in 2022 (Figure 3).

Conclusion

The vote of confidence that the investments from across the world have given the UAE is nothing short of spectacular. Not only is the UAE easily the leading host country in the Middle-east, it is starting to make its mark on the world stage. Adjusted for its size (i.e., relatively small GDP), the UAE is providing stiff competition to top FDI destinations such as the USA, China and India.

References

CS Global (2023) World Citizenship Report 2023, CS Global Partners, London, htps://csglobalpartners.com/world-cizenship-report/ (Accessed 8 September 2023)

Dunning, J. (1988) ‘The Eclectic Paradigm of International Production: A Restatement and Some Possible Extensions’, Journal of International Business Studies, 19, pp. 1–31.

IMD (2023) World Compeveness Ranking 2023 Results, https://www.imd.org/centers/wcc/worldcompeveness-center/rankings/world-completeness-ranking/2023/ (Accessed 8 September 2023)

Kishore, P. (2023) Foreign Direct Investment and its Relationship with Financial Factors: Linking Macro with Micro Perspectives, Unpublished Ph.D. Thesis, Middlesex University

UNCTAD (2023) World Investment Report 2023, United Nations, New York, htps://unctad.org/publicaon/world-investment-report-2023 (Accessed 8 September 2023)

World Bank (2020) Ease of Doing Business 2020, World Bank, Washington DC,

https://archive.doingbusiness.org/en/reports/global-reports/doing-business-reports (Accessed 8 September 2023)

World Bank (2023) Worldwide Governance Indicators (WGI) Project, World Bank, htps://info.worldbank.org/governance/wgi/ (Accessed 8 September 2023)