The FDI Formula: Secrets to Attracting Investment

Pallavi Kishore,Senior Lecturer, Middlesex University Dubai

(This note is a compilation of material and findings from my Ph.D. thesis, highlighting and summarizing the key points and discoveries)

Foreign Direct Investment (FDI) holds immense significance in the global economic landscape, and its impact is underscored by substantial transactions, surpassing USD 1.39 trillion in 2019 (UNCTAD, 2020). FDI represents a fundamental mechanism for cross-border capital movement, as businesses invest in foreign countries to establish or expand their operations.

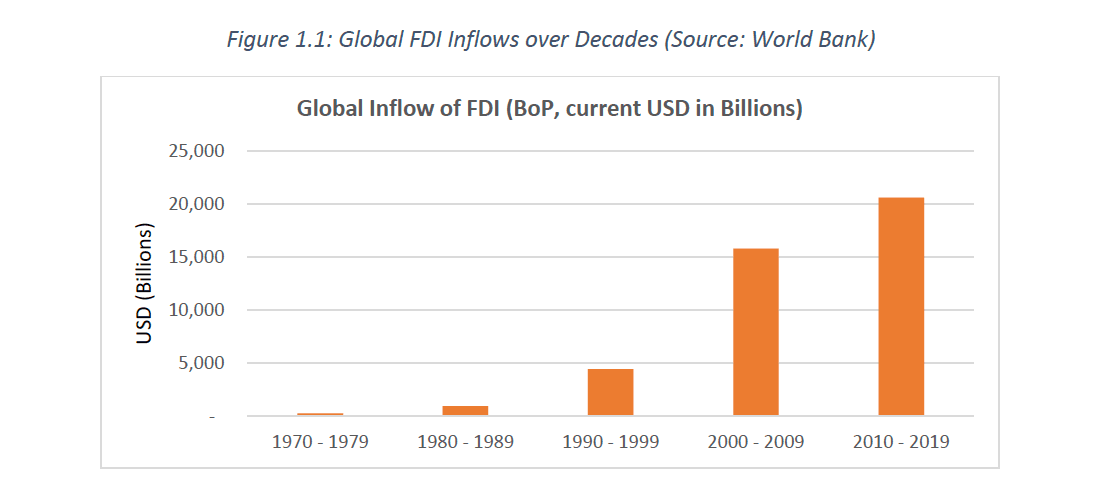

Global FDI has increased significantly in the last few decades, and Figure 1.1 highlights these changes, demonstrating the importance of FDI. FDI has surged by over 9800% from 1970 to 2020 (World Bank Development Indicators, 2021). FDI is poised for continued growth in the coming decade, with post- pandemic acceleration of pre-existing trends expected to create investment opportunities and foster further development (Zhan, 2020).

The substantial increasein FDI stands as a testament to the benefitsit offers. Beyond fostering economic development and facilitating international trade, FDI asserts its potential to enhance employment, offer tax incentives, and bolster productivity (Benefits and Advantages of Foreign Direct Investment, 2021). Furthermore, countriestend to attract FDI as they allow for technology transfer, contribute to human capital development, and increase the host country’s income (Loungani and Razin, 2001). FDI has long been a hallmark of globalization, helping transform entire firms, cities, sectors, and economies.

Indeed, nations persistently seek avenues for augmenting their FDI inflows. The pertinent question persists: what strategies should they employ to achieve this objective? While traditional approaches encompass the examination of macro factors (economic and regulatory), it is equally imperative to consider the underexplored institutional factors. Furthermore, we extend its purview to introduce the novel dimension of financial factors into the equation along with the seldom studied micro-level dynamics.

In the context of international investment, corporates engage in a comprehensive evaluation of diverse options, guided by their motivations across macro and micro levels.This deliberative processcommences with the selection of a targetcountry, chiefly underpinned by macro considerations, such as marketsize, trade regulations, inflation metrics, and financial stability. Subsequently, after the nation of focus has been determined, the next phase entails the identification of a suitable partner company for investment. This selection processconsiders micro factorssuch as industry, corporate maturity, and financial metricssuch as returns, capital structure, debt load, and share price dynamics.

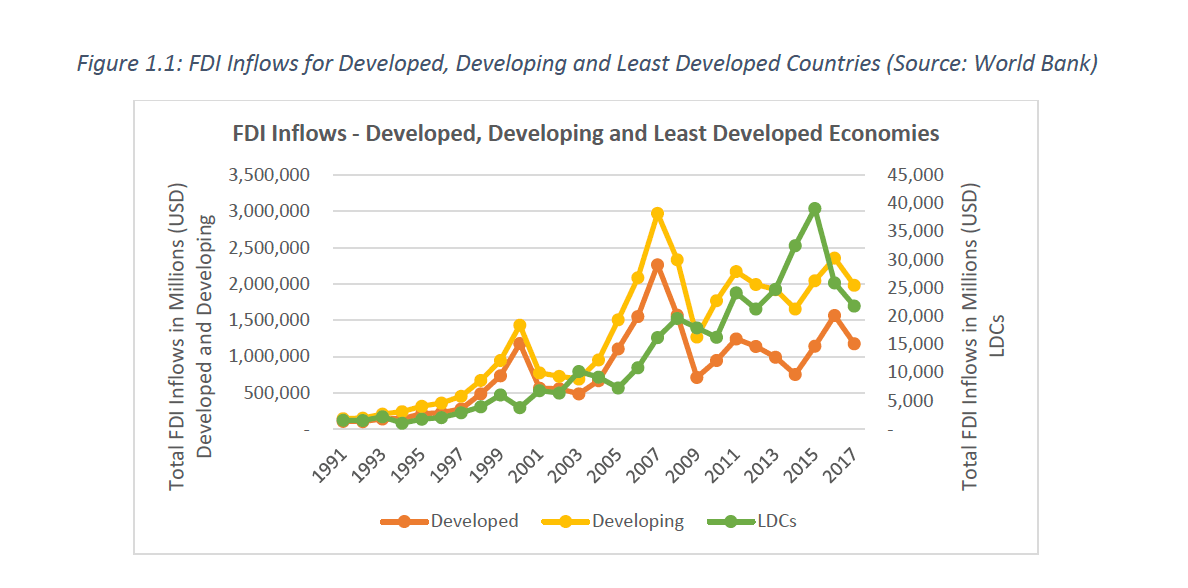

Beyond these variables, the stage of development of a countryis a pivotal factor influencing the decision to engage in FDI. The United Nations’ World Economic Situation and Prospects categorizes nations into three overarching groups: developed, developing, and Least Developed Countries (LDCs). These categorizations are designed to capture economic characteristics and conditions within each group.

Figure 1.2 shows the total amount of FDI attracted by each category of economies for the period 1991 – 2017. Developed and Developing countries’ values are depicted along the left y-axis, while LDCs are represented by the right y-axis.

The current studyanalyzes determinants of FDI acrossdifferent levels of development usinga large panel of 179 countries over 27 years (1991-2017).

Using equation 1.1 and employing the Fixed Effects (FE) methodology, we uncover noteworthy findings. Developed countriestend to attract FDI most easily, whileLDCs face greaterchallenges. This is due to the differing number of significant variables between developed and LDCs when compared to developing nations. For developed countries, key FDI drivers include a high GDP, trade openness, currency stability, and economic freedom. Developing countries require additional factors like human capital, low costs, infrastructure, political stability, and favourable financial factors such as liquid liabilities, private sector credit, and accessto loans from non-resident banks.LDCs benefit from human capital,trade openness, tax incentives, political stability, opportunities for non-resident bank loans, and the possibility of offshore bank deposits as significant determinants for attracting FDI. The validityof these findingsis further ensuredby employing Extreme Bound Analysis (EBA), effectively addressing endogeneity concerns.

Extending the analysis with Mean Group (MG) and Pooled Mean Group (PMG) estimators, we establish that economic, regulatory, and institutional factors retain their significance in both the short and long term across different development levels.Notably, financial factorsexhibit significance solely in the long term for developed and developing economies, while they hold significance in both the short and long term for LDCs. This confirms that relying solely on aggregate global data does not provide a comprehensive perspective. Instead, policymakers and companies aiming to enhance their FDI inflows should employ disaggregated data for more nuanced insights.

Next, we delve into the micro-level dynamicswithin a developing country. When a firm opts to invest in a developing nation, the crucial decision lies in selecting a suitable partner company for investment. This part of the study includes both listed and unlisted firms within India for the period 2010 to 2018, representing a total of 50,268 firms.

Applying logistic regression to equation 1.2, we discern that the determinants that increase the odds of receiving foreign investment include factors such as total asset size, profitability, gearing, company age, industry, investments in technological expertise, and expenditures on research and development.

Utilizing the Generalized Method of Moments (GMM), the analysis reveals that when a country seeks foreign investment, it is essential that individual firms exhibit financial robustness. Larger and more established companies not only have a higher probability of attracting foreign investments but also tend to secure a larger share of such investments. The size of a company,measured by its total assets,directly correlates with increased odds and a larger share of foreign investments. Consistently, firms that yield favourable returns to shareholders have a greaterlikelihood of receivingforeign investments. In addition, gearing, being a risk factor(Gill, Obradovich and Mathur, 2015),indicates that highlyleveraged firms with substantial outstanding loans face reduced prospects of attracting foreign investors.

In addition to financial factors, foreign firms are also influenced by non-financial characteristics such as a company’s age, industry, technological investments, and R&D spending (Lin, 2010). Older, more established firms are significantly more attractive to foreign investors, indicating a preference for stability and experience. Non-financial services industries have a higherlikelihood of receivingforeign investments when comparedto the financial sector, despiterecent regulatory relaxation. The study also highlights the appeal of firms that investin technology and innovation throughR&D, as they tend to attract more foreign investments.

Interestingly, liquidity (current ratio) and efficiency (receivable days) are not significant determinants of foreign investment. Short-term cash crunchor receivables are not crucialfor investors, as any short-term liquidity gaps can be swiftly addressed. However, the presence of larger long-term loans, as indicated by the gearing ratio, acts as a significant deterrent to investment decisions.

These findings have substantial relevance for investment considerations. They offer valuable insights for policymakers and businesses seeking foreign investments, aiding them in shaping effectiveregulations and policies. These results distinguish between critical and less significant indicators in the investment decision-making process. While this study is centred on the Indian economy, its implications have wider applicability for any developing nation pursuing foreign investments.

References

Gill, A., Obradovich, J. D. and Mathur, N. (2015) ‘Promoterownership and corporate leverage: Evidence from Indian firms’, Corporate Ownership and Control, 12(3CONT5), pp. 513–521. doi: 10.22495/cocv12i3c5p3.

Lin, F.-J. (2010)‘The determinants of foreign direct investment in China: The case of Taiwanese firmsin the IT industry’, Journal of Business Research, 63(5), pp. 479–485. Available at: https://econpapers.repec.org/RePEc:eee:jbrese:v:63:y:2010:i:5:p:479-485.

Loungani, P. and Razin, A. (2001) ‘How Beneficial Is Foreign DirectInvestment for Developing Countries?’, Finance and Development, IMF, 38(2).

Research FDI (2021) Benefits and Advantages of Foreign DirectInvestment. Available at: https://researchfdi.com/resources/articles/benefits-fdi-foreign-direct-investment/

Research FDI (2023)Investment Attraction. Available at: https://researchfdi.com/. The World Bank: IBRD RDA (2023). Available at:

www.worldbank.org/en/home?cid=ECR_GA_worldbank_EN_EXTP_search&s_kwcid=AL!18468!3!

665425039372!b!!g!!world bank projects&gclid=Cj0KCQiAo7KqBhDhARIsAKhZ4ujvNfGMbYvlsr- 4ne2laPdmOxDy9_VTRMgHYRmUqr3xk_Z1xGuJEn4aAkzEEALw_wcB.

UNCTAD (2020) ‘WorldInvestment Report, International Production Beyond the Pandemic’, United Nations. Available at: https://unctad.org/system/files/official-document/wir2020_en.pdf.

World Bank (2021) World Bank Development Indicators. Available at: https://databank.worldbank.org/source/world-development-indicators

Zhan, J. (2020)The future of FDI: driversand directions to 2030. Available at: www.fdiintelligence.com/article/79112.